Large physical retailers could push back competition from an online retailer Amazon.com Inc. by continuing to offer Curbside pickup and other contactless delivery services that are expected to expand in the coming years, according to industry experts.

US sales for click-and-collect services are expected to reach over $ 100 billion in 2022, up from $ 83.47 billion in 2021 and $ 72.46 billion in 2020, according to the latest data from eMarketer.

Click-and-collect services allow consumers to purchase pronline products and Photostore items in the store or in a designated area such as a locker, kiosk or parking lot. Demand for these services increased dramatically during the pandemic as they allow U.S. consumers purchase goods while minimizing physical contact.

Retailers that offer these services, such as Walmart Inc., Target Corp., Home Depot Inc. and Best Buy Co. Inc., have a significant competitive advantage. on Amazon thanks to their large store footprints, said Andrew Lipsman, Senior Analyst at eMarketer.

“These four companies, in particular, I think, are very well positioned for what is likely to be one of the key behaviors that stem from the pandemic,” Lipsman said.

Amazon has over 500 Whole Foods Market Inc. stores and is developing a new concept of grocery shopping, but it will take years for Amazon to develop the kind of store footprint that could compete in the click-and-collect arena with retail. leaders, said Lipsman.

Buying pickup ordering services online is nothing new. Some physical retailers started offering the service around a decade ago, in part to better compete with Amazon.

But retailers have ramped up those services in response to the pandemic as shelter-in-place orders rolled out across the country. Best Buy turned to a contactless model, at the curb only in the first trimester and I saw a increasing demand in categories such as computers, games and small devices. The Home Depot has extended its free curbside pickup service to most stores as an extension of its online shopping / in-store pickup option, while Walmart has increased its capacity for pickup and delivery services. Target’s order pickup service grew by more than 50% in the third quarter, while the company’s Drive Up service increased by more than 500%.

Consumers may eventually return to stores for their entire shopping trip as COVID-19 vaccinations roll out, but contactless options have become a convenient alternative for in-store purchases, especially in areas such as ‘grocery store and home improvement, said Dave Gill, vice president of information and analytics at Rakuten Intelligence.

Consumers now know they can rely on pickup delivery methods as retailers have continued to improve order processing and offer substitutions for out-of-stock products, he said.

“Consumers are not going to go back,” said Gill. “If the experience improves and I don’t take the wrong brand or size, then it’s just going to become more entrenched.”

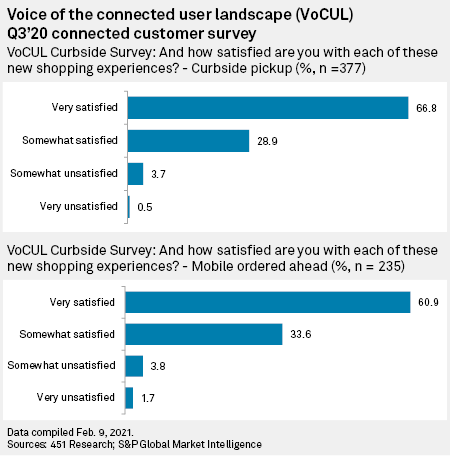

The majority of consumers appear to be satisfied with curbside pickup. According to the latest “Voice of the Connected User Landscape” survey from 451 Research, nearly 67% of respondents who tried curbside collection services for the first time said they were very satisfied with the experience. . Almost 29% said they were somewhat satisfied, while 3.7% were somewhat dissatisfied. Meanwhile, over 60% of survey respondents who tried a mobile-ahead ordering service for the first time said they were very satisfied. This service would include ordering Starbucks coffee online and then picking it up at the store, for example.

Still, curbside pickup isn’t necessarily a big blow to retailers, said Sheryl Kingstone, head of customer experience and commerce research at 451. She noted that there is still a large number of consumers who are ambivalent about these services.

Specific use cases for curbside pickup may become more apparent over time, said Jordan McKee, director of research at 451. Consumers may take advantage of the service for reasons other than minimizing contact during the trip. pandemic, including avoiding long lines during holidays or bad weather, he said.

“You’ll start to see some of these specific sidewalk use cases with consumers who may have tried it for the first time out of longer-term necessity as the virus retracts,” he said. .

451 The research is part of S&P Global Market Intelligence.