jetcityimage/iStock Editorial via Getty Images

One of the most iconic restaurant brands in the United States is none other than Cracker Barrel Old Country Store (NASDAQ: CBRL). Over the years, the company’s management team has done a decent job work increasing the physical presence of the company and its turnover. Like many businesses in the restaurant industry, Cracker Barrel has also been hit hard by the COVID-19 pandemic. But performance since then has been encouraging and shows that the worst for the company is probably over. Some investors may be concerned about current market conditions and the possibility that financial performance will suffer in the short term. But even if that happens, the company doesn’t seem to be worse off than fairly valued. And in the event that the financial performance ahead looks more like what the company achieved in 2021, the upside could be quite attractive.

A quality restaurant

Cracker Barrel is largely focused on owning and operating its Cracker Barrel-branded restaurants. This restaurant concept consists of a trademark rustic country store design that offers home-style dishes, as well as a variety of homewares, gifts, toys, clothing, kitchen utensils and foods that customers can purchase while waiting to be seated or after eating. Typically, all of the company’s stores are company-owned, and all of them are also stand-alone buildings.

It should be noted that at the end of its 2021 fiscal year, the company generated approximately 79% of its revenue from the food it sells in its restaurants. As of 2020, this also included a limited selection of beer and wine products currently available at approximately 72% of company locations. Company breakfast prices can range from $4.99 to $14.99, while lunch and dinner prices usually range from $5.19 to $17.99. For the 21% of sales attributed to the various goods that the company sells, it is interesting to note that clothing and accessories represent 29% of these revenues. Food products, such as candy bars and pancake mixes, account for 18%. Decoration accounts for 13% of sales, while toys correspond to this. And media products represent 8% of turnover.

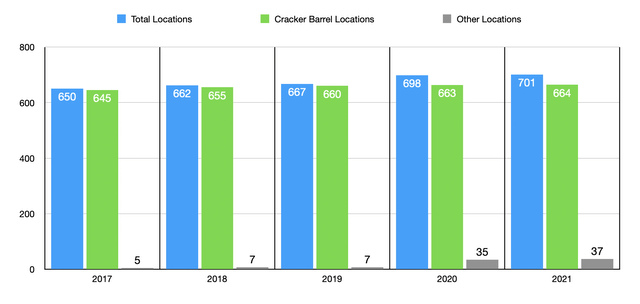

Author – SEC EDGAR Data

In addition to its flagship stores, Cracker Barrel also has a few additional food concepts to its name. One of these concepts is called Maple Street Biscuit Company, which serves as a fast food restaurant for breakfast and lunch and offers entrees inspired by cookies, roasted coffee, beer, wine and other products. related. Until 2020 the company also had locations called Holler & Dash, but these were eventually converted to Maple Street Biscuit Company stores.

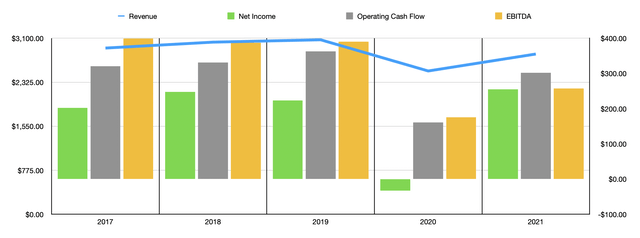

Author – SEC EDGAR Data

In the years leading up to the pandemic, Cracker Barrel sales increased slightly from $2.93 billion in 2017 to $3.07 billion in 2019. The pandemic caused 2020 revenue to drop to just 2 .52 billion. However, much of that bounced back in 2021, with revenue hitting $2.82 billion for that year. Generally, Cracker Barrel is likely to grow in the future. Although comparable store sales were mixed year over year, the company continues to increase its number of stores. At the end of 2017, for example, the company had 650 locations in operation, including 645 under the Cracker Barrel name. By 2021, the total number of locations had grown to 701. Of these, 664 were Cracker Barrel locations, while the remaining 37 fell under the company’s other properties. So far in 2022, the company’s situation is improving. First-half revenue totaled $1.65 billion. That compares to $1.32 billion generated a year earlier. Although the company continues to increase the number of locations it has, it has benefited from stronger in-store sales. However, the company expects some weakness through at least the third quarter of the year, with expected sales of around $800 million. On the plus side, that would be at least a year-over-year increase from the $713.4 million in revenue the company made a year earlier.

Author – SEC EDGAR Data

In the end, the company’s image was generally favorable. Net profit rebounded between $201.9 million and $247.6 million in the three years ending in 2019. The company then lost $32.5 million in 2020 before posting a profit of $254.5 million last year. Other profitability parameters must also be examined. A good example would be operating cash flow. This metric increased steadily between 2017 and 2019, from $320.8 million to $362.8 million. Cash flow dipped to just $161 million in 2020 before climbing to $301.9 million last year. A similar trend can be seen when looking at EBITDA. After dropping from $390.4 million in 2019 to $175.6 million in 2020, it then partially recovered to $257.5 million.

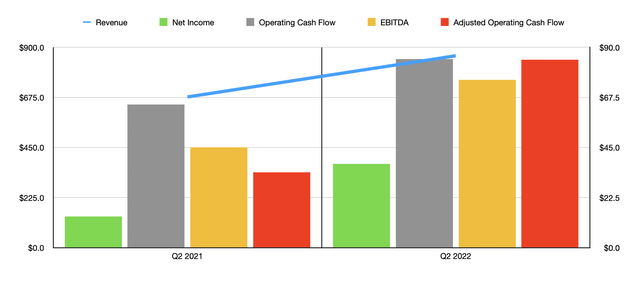

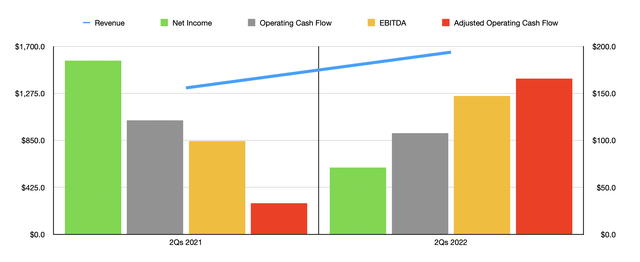

Author – SEC EDGAR Data

As for the current financial year, the picture could be better. Net profit for the first half of the year totaled $71 million. That compares to $184.7 million reported a year earlier. Operating cash flow also decreased from $121.3 million to $107.8 million. But if we adjust for changes in working capital, it would have gone from $33 million to $165.8 million. Meanwhile, the company’s EBITDA also improved, from $99.1 million in the first half of 2021 to $147.3 million in the same period this year.

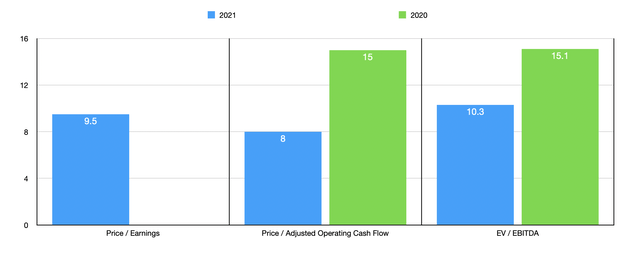

Unfortunately, management did not provide any detailed guidance for fiscal year 2022. They did, however, say that inflation would be particularly painful in the third quarter of the year. To value the company then, I decided to look at it from the perspective of the rather strong 2021 financial year, as well as the tumultuous 2020 financial year. Using our 2021 results, we see the company trading at a price/earnings multiple of 9.5. The company generated a loss in 2020, so we cannot calculate a multiple there. Using the price/operating cash flow approach, we get a multiple of 8. This compares to the 15 we get if we use 2020 data. And finally, using the EV-to-EBITDA approach , we get a multiple of 10.3. That’s down from the 15.1 we get if we go by the 2020 numbers.

Author – SEC EDGAR Data

To put the company’s pricing into perspective, I decided to compare its 2021 valuation to the valuations of five similar companies. On a price/earnings basis, four of these five companies posted positive results, with the multiple ranging from a low of 9.6 to a high of 57.9. Our prospect was the cheapest of the group. Using the price/operating cash flow approach, the range was 5.2 to 40. In this case, two of the five companies were cheaper than Cracker Barrel. And finally, using the EV-to-EBITDA approach, the range was 5 to 36.8. In this case, only two of the five companies were cheaper than our prospect.

| Company | Prizes / Earnings | Price / Operating Cash | EV / EBITDA |

| Cracker Barrel Old Country Store | 9.5 | 8.0 | 10.3 |

| Wing stop (WING) | 57.9 | 40.0 | 33.2 |

| Papa John’s International (PZZA) | 54.3 | 19.1 | 17.3 |

| Blooming Brands (BLMN) | 9.6 | 5.2 | 5.0 |

| Shake the shack (SHAK) | N / A | 30.9 | 36.8 |

| Dave & Buster Entertainment (PLAY) | 16.3 | 6.2 | 6.9 |

Take away

Right now, times are a bit uncertain for Cracker Barrel. The company faces inflation and a range of other issues such as the prospect of a weakening economy and the potential rise of COVID-19 again. However, it’s hard to imagine the company performing worse than in 2020. And in that case, it seems to me that the shares could be fairly priced. Any better scenario than that, and we end up with a company that’s quite attractive from a valuation perspective. And because of that, I can’t help but rate the company as a “buy” at this time.