MarsBars / E + via Getty Images

The recent market rally has been great for short-term buyers, but not so good for long-term value investors looking to invest capital at attractive prices. That’s why it’s always good to have a few default purchases on hand for those times when value is hard to come by.

I find this to be the case with STORE Capital (STOR), which is neither cheap nor expensive at the moment. In this article, I highlight why STORE fits the mold of a “Wonderful Fair-Priced Business”, especially in this sparkling stock market.

A wonderful business at a fair price

STORE Capital is a fast growing, internally managed net rental REIT focused on the ownership of profit center buildings that are leased to mid-market and larger companies in the United States. Currently, its portfolio consists of 2,788 properties leased to 538 tenants in 119 various industries and 49 states.

STORE buildings are generally profit centers for the tenant, and therefore are operationally essential. This is a prudent strategy, as profit centers are less likely to be closed than cost centers. In addition, the vast majority of STORE locations (98%) are subject to financial reporting at the unit level.

This benefits STORE in that it gives management the ability to quickly identify any financial issues that may arise with a tenant location and plan an appropriate course of action. STORE also benefits from long-term leases, with a weighted average lease term of 13.5 years, one of the highest of the net rental area.

STORE continues to perform well in the current environment, with an occupancy rate of 99.4% and revenue growth of 13.6% year-on-year in the third quarter (revenue growth of 10 % year-on-year in the first nine months of 2021). Management has also been active on the acquisition front, creating an acquisition volume of $ 412 million in the third quarter alone, as STORE tenants turned their attention to growth initiatives in the currently strong economy.

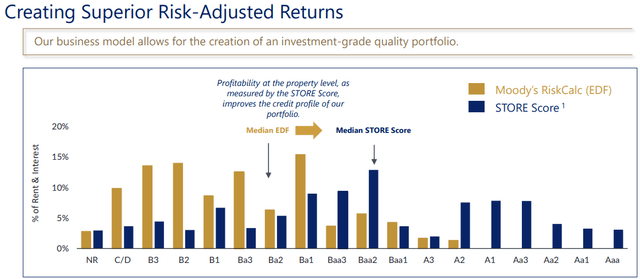

STORE also offers an attractive investment strategy, as it seeks to invest in quality rental properties at replacement cost or below. STORE’s internal measurement tool (based on unit-level reporting) suggests that the median tenant financial credit score is a strong Baa2, well in investment grade territory, and 72% of contracts are rated in the investment category.

(Source: Investors Presentation)

This exclusive model allows STORE to purchase quality properties at attractive capitalization rates with a weighted average annual rent increase of 1.8%. This is reflected in the weighted average initial capitalization rate of 7.7% on properties recently acquired during the last published quarter.

This compares favorably to STORE’s cost of equity of 6.35% (based on AFFO / management share forecast of $ 2.175 at midpoint, and the current share price of $ 34.24). STORE’s investment spread widens further when we take into account the low cost of debt of 2.8% on the recent $ 515 million long-term fixed notes that STORE has issued.

For the future, I see a healthy growth path for STORE, because its target market is composed of 215,000 companies. As noted below, STORE’s target market represents only a fraction of the total addressable market for single-tenant properties in the United States.

(Source: Investors Presentation)

Additionally, management is aiming for strong growth even in an inflationary environment, as discussed below during the recent conference call:

“Now I would like to talk about inflation, which is the current macroeconomic topic. For a few key reasons, we believe that STORE is well positioned to generate strong AFFO growth, even in an inflationary environment. First, as a REIT triple net lease, STORE does not incur any operating expenses related to real estate.

Second, we have integrated into our leases contractual indexations of the average annual rent of nearly 2%, which constitutes a natural hedge against inflation. Third, we have flexible funding options and our existing portfolio is funded with well-timed fixed rate debt and no significant maturities until 2024.

Finally, we have a strong pipeline of new opportunities. And given our direct approach to acquisitions, we have the flexibility to structure new leases based on the current operating environment. “- CEO of STORE Capital

Meanwhile, STORE maintains a strong BBB rated balance sheet and a safe net debt to EBITDA ratio of 6.16x. It also recently increased its dividend by an impressive 6.9%. The new dividend rate comes with a safe AFFO payout ratio of 71% (based on AFFO / share 2021 forecast of $ 2.175).

Risks to STORE include uncertainties surrounding the recent dismissal of executive chairman and founder Christopher Volk without cause, as the company could miss its expertise and guidance. In addition, higher interest rates can increase STORE’s cost of debt, and increased competition for transactions can lower capitalization rates.

Considering all of the above, I see a value in STORE at the current price of $ 34.24 with a forward P / FFO of 18.3. This takes into account the strengths inherent in the company as well as the growth rate of AFFOs / share of 9.3% that management forecasts for the year 2021.

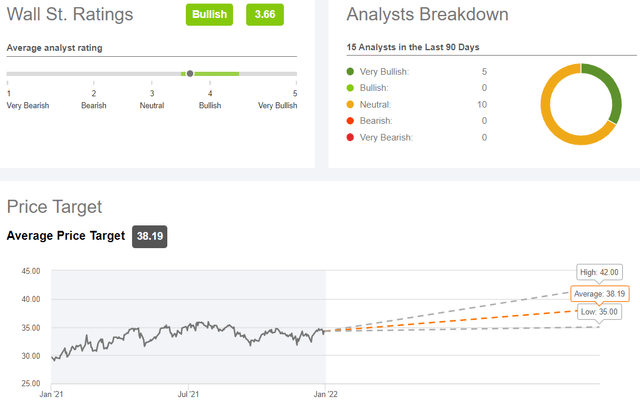

Additionally, analysts estimate FFO / share growth of 8.5% next year and have a consensus buy rating, with an average price target of $ 38. That implies a potential total return of 16% over one year including dividends, which isn’t bad considering the rather foamy stock valuations at the moment.

(Source: In Search of the Alpha)

Takeaway for investors

STORE Capital is a uniquely positioned net rental REIT with a sustainable and rapidly growing business. It enjoys a healthy occupancy rate, continues to make profitable acquisitions and has a strong pipeline of transactions.

Meanwhile, its credit rating was recently upgraded from BBB stable to positive by S&P and it has demonstrated solid dividend growth. While STORE isn’t cheap, I don’t find it expensive either. STORE is a buy for potentially strong long term returns.