onurdongel/iStock via Getty Images

You are paying way too much for what is given free.” – William Shakespeare, The Winter’s Tale

Today we take an in-depth look at a retail company that looks cheap on a variety of metrics after a sharp drop in the stock. The shares have also been the subject of recent insider buying. A full analysis follows below.

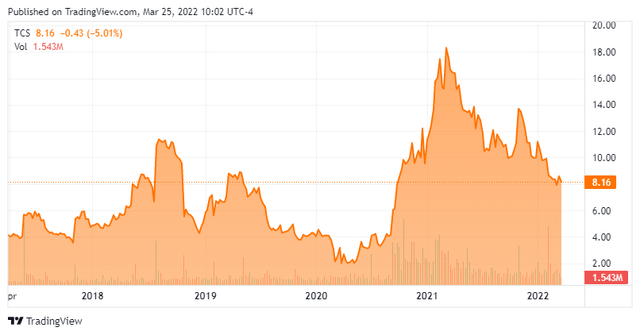

TCS – Stock Chart (Seeking Alpha)

Company presentation:

The container store (NYSE: TCS) (hereafter “TCS”, “Retailer” or “Company”) is a Dallas-based specialty retailer focused on providing storage and organization solutions to customers in approximately 30 countries. Nationally, the company operates 94 stores in 33 states and the District of Columbia and is the only major company dedicated solely to the category. TCS was founded in 1978 and went public in 2013, generating net proceeds of $205.8 million at $18 per share. Its stock is currently trading just above $8.00 per share, which equates to a market capitalization of $405 million.

The retailer operates on a fiscal year ending the Saturday closest to March 31 and refers to the year ending April 2, 2022, as FY21.

Report segments

It has two operating segments: The Container Store and Elfa.

The Container Store is home to the 94 national retail stores (averaging approximately 25,000 square feet in size) and the call center, its web and mobile sites, and its custom closet installation business. The outlets are supplied from two distribution centers in Texas and Maryland. This division is responsible for the preponderance of the company’s revenue, accounting for $736.7 million in the nine months ending January 1, 2022 (YTDFY21), or 93% of the total.

Elfa is the retailer’s wholly-owned Swedish subsidiary, which it bought in 1999. It manufactures component-based shelving and drawer systems, as well as bespoke sliding doors from facilities in Sweden and Poland. The Container Store segment is Elfa’s exclusive distributor in the United States and this arrangement provides the former with its most popular and profitable products. Elfa also sells its wares to retailers in approximately 30 countries, with most of its non-US revenue coming from the Nordic region. It earned $51.8 million in YTDFY21 revenue, or 7% of the total.

Single slot

Besides being the only company dedicated exclusively to storage and organization solutions, two distinctive features set TCS apart from its competitors. The first is its bespoke closet business, which includes design, customization, product and installation. Custom closets represent about half of the company’s turnover. The second is the range and depth of category offerings the retailer offers, amounting to over 11,000 SKUs from over 650 vendors.

Marlet

While the only one to fully commit to the category, TCS participates in a $20+ billion global storage and organization vertical (which includes custom closets), meaning it has only reached than 5% penetration and less than 10% of the approximately $6 billion custom closet market. . Competitors include offers of Bed Bath and Beyond (BBBY), Home Depot (HD), Lowe’s Companies (LOW), Target (TGT)and many non-public regional companies.

Trading history

Shares of TCS opened with a bang in 2013, trading $17 above its IPO price in its inaugural public transaction, then breaking through $47 per share towards the end of the same year. Even though the company increased its number of stores by about 50%, reduced its debt by more than 40% to $196.6 million (dropping its leverage from 3.9 to 1.1) and became profitable on a GAAP basis in the meantime, his stock has been more or less a bust, falling from 2016-2019 preponderance to trade in single digits, before dropping below $2 in the pandemic-induced selloff. of March 2020. The slow slump in its share price was a function of investors waiting for capital from its IPO to launch a rapid expansion of stores to further penetrate its vast untapped market and this did not materialize . At its peak in 2013, TCS shares traded at a price-to-sales ratio of around 3.0, but when the company only grew revenue at a CAGR of 3.4% during of the following six years by only increasing the number of stores to 8.4% CAGR – with only four new sites since March 2018 – investors betting on growth have moved away. At its nadir in March 2020, its stock was trading around 0.1 price from sales.

Mindsets changed when the retailer was rightly seen as a beneficiary of the dynamic stay-at-home and Covid-19 relief payments during the pandemic. It also benefited from the launch of Netflix (NFLX) series Get organized with The Home Edit in September 2020. As such, its stock rebounded around 900% over the following year, peaking just below $20 per share in March 2021. That said, sales only increased by 8% in FY20 (ending April 3, 2021) compared to FY19, partly due to temporary store closures in 1QFY20.

Opinions reversed again, with the market viewing the undercurrents of the pandemic as simply a surge in demand, and the stock returned to low double-digits.

During 1HFY21, these concerns seemed unfounded, as the company gained $0.89 per share versus $0.11 per share (both non-GAAP) in a somewhat pandemic-affected 1HFY20, while increasing its Adj. EBITDA of 68% to $81.3 million on a 30% increase in revenue to $521.3 million.

Results and outlook for 3QFY21

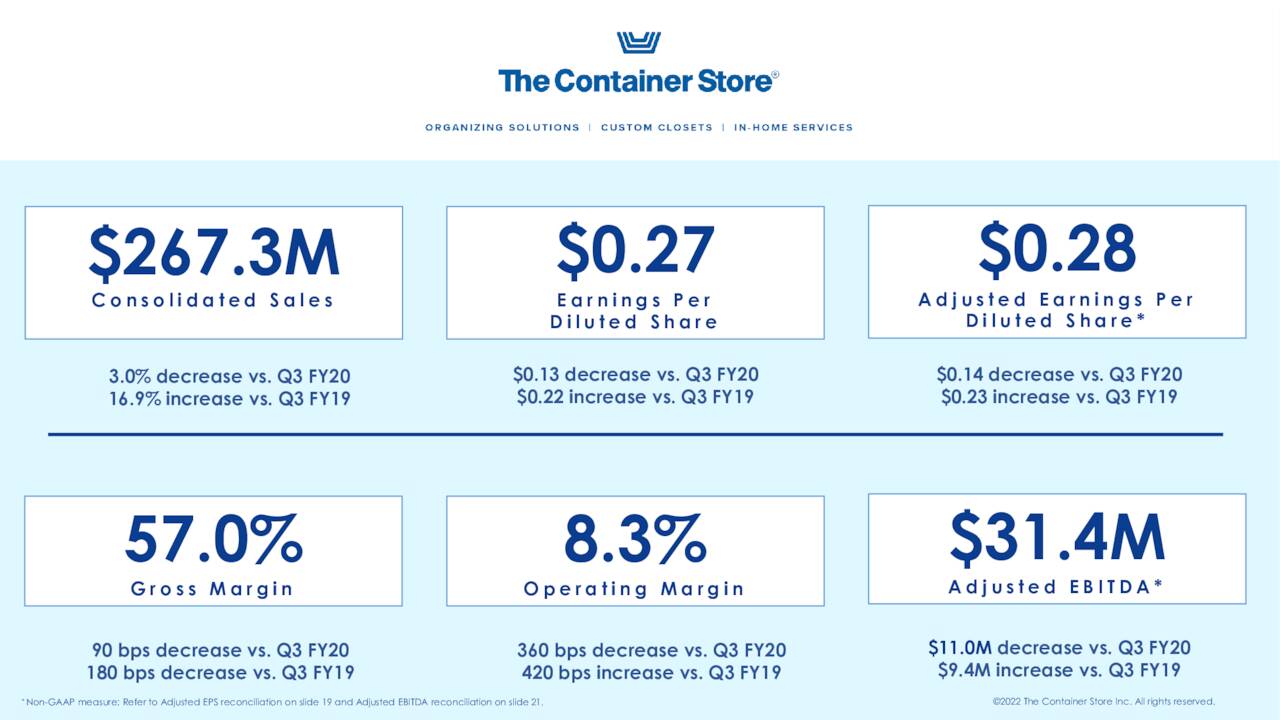

However, the bearish view gained further validity when TCS released its 3QFY21 results on February 8, 2022. It was not the report itself but rather the outlook for 4QFY21 that emboldened the naysayers. The retailer reported non-GAAP EPS of $0.28 and Adj. EBITDA of $31.4 million on consolidated net sales of $267.3 million, with net earnings beating Street consensus by $0.07 per share and earnings outperforming by $5.3 million. That said, all three metrics were significantly lower than their 3QFY20 comparators, when the company reported $0.42 per share (non-GAAP) and Adj. EBITDA of $42.4 million on revenue of $275.5 million, representing year-over-year declines of 33%, 26% and 3%, respectively.

3rd quarter results (company presentation in February)

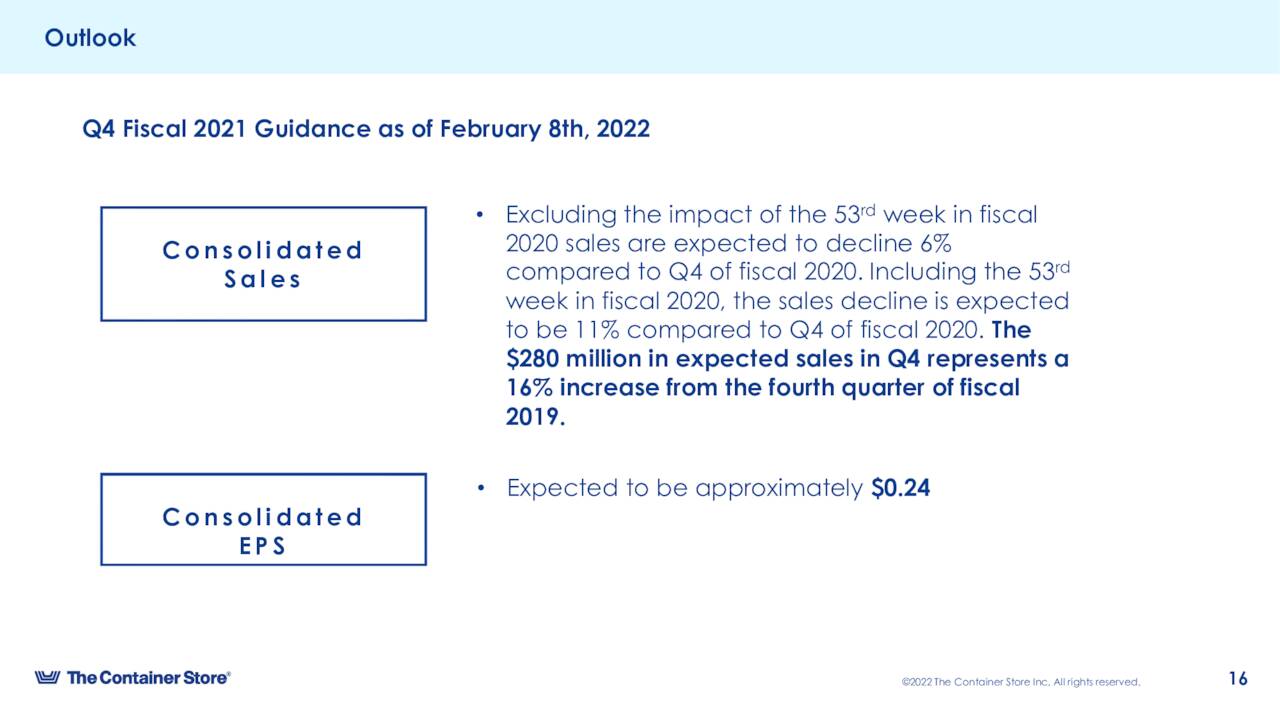

Management’s outlook for 4QFY21 of $0.24 per share (non-GAAP) was down 66% from the prior year period and was $0.06 below Street consensus. Its revenue estimate of around $280 million represented an 11% decline from 4QFY20 (6% considering the 14-week quarter a year earlier).

Fourth Quarter Guidance (February Company Presentation)

Pandemic-related headwinds such as increased freight and raw material costs in its Elfa segment were blamed and management felt that the best approach to interpreting the company’s results was against those reported. during FY19. This line of thinking seems more logical for a company whose financial performance has been negatively impacted by the pandemic and which is trying to demonstrate that its growth trajectory is picking up, and not one which has taken advantage of it and is trying to rationalize this despite its [NOW] two quarters of decline is still better than two years ago.

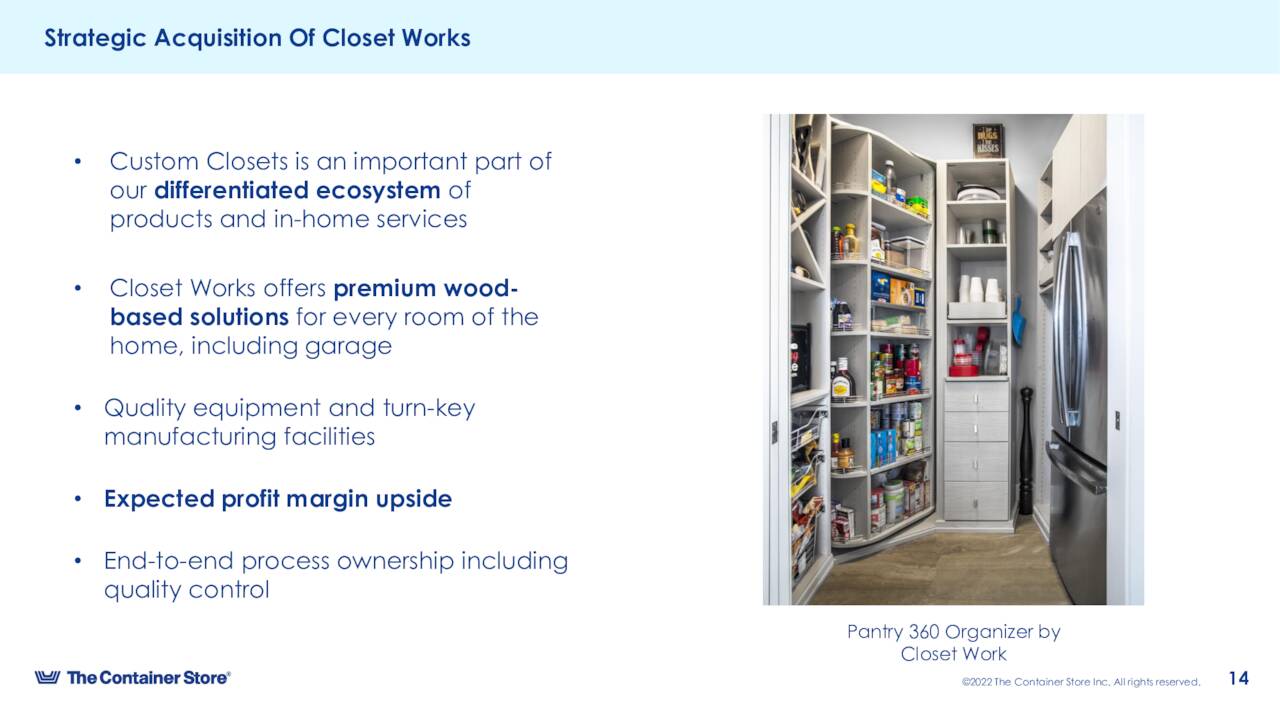

Acquisition of Closet Works (company presentation in February)

On a positive note, TCS said strong demand in its bespoke closet business compelled it to acquire Closet Works, a manufacturer of high-end bespoke wooden spaces, including walk-in closets, wine cellars , etc., for a net amount of $19.4 million. cash acquired during FY3QFY21.

Management also stated its intention to become a $2 billion company in the future with more than 200 physical locations, but no detailed roadmap was provided.

Instead, the market chose to focus on the company’s forecast for 4QFY21, causing its stock to drop 23% to $8.13 per share in the following trading session, shares rebounded a little since then.

Report and commentary from analysts

If TCS decides to go ahead with a significant expansion plan, it is in a strong capital position to do so with a leverage ratio of 1.1. As of January 1, 2022, the retailer held cash of $19 million against debt of $198.7 million with $76 million of additional cash available on two lines of credit. It generated cash flow from operating activities of $17.9 million in YTD21. These measures contradict its strong cash position, as it accumulated inventory of $66 million (51%) during the period.

The retailer is under-followed and unloved by Street analysts. Goldman Sachs moved it from sell to hold in November 2020, raising its price target from $3 to $10. JP Morgan maintained its sell rating and price target of $12 in mid-February. Although silent on comments, analysts currently expect TCS FY23 net income will decline 15% to $1.23 per share (from $1.45 in FY21E) on a flat high of $1.07 billion.

In contrast, CEO Satish Malhotra is firmly in the bullish camp based on his post-earnings purchase on Feb. 10, 2022 of 24,355 shares at $8.17, taking his position in the company to over 185,000.

Verdict

Until the retailer moves on and finally turns the page on the negative comparisons, it will struggle to convince investors that it is anything more than a low-to-low single-digit organic producer. business. And inflationary headwinds will certainly hamper the retailer’s ability to market themselves as a bottom line producer.

As such, its shares trade at a price to FY21E (and FY22E) of less than 0.4, an EV to EBIDTA of 3.2, and a price to FY22E earnings of 6, 5. These are stocks that should put a floor under TCS shares, but they don’t have much upside until management can change Street’s perceptions of its growth prospects. As such, the recommendation is to stay on the sidelines.

Forgotten wisdom is the knowledge of failure.”-Anthony T. Hincks

Bret Jensen is the founder and author of articles for the Biotech Forum, Busted IPO Forum and Insiders Forum