ablokhin/iStock Editorial via Getty Images

Thesis

Investors are often faced with the choice between a sector fund and a sector-specific stock. This article uses the Vanguard Real Estate ETF (NYSEARCA:VNQ) and STORE Capital (NYSE: STOR) to illustrate the top-down investment approach that we use ourselves and also in our marketplace service. This comparison also serves as a textbook example to illustrate the cornerstones of buffettism, given that STOR is Buffett’s only holding REIT and he has openly advised against holding index funds such as VNQ if you know what you’re doing.

In particular, in this article, you will see that:

- VNQ is a diworsification and why we believe a more focused bet on STOR can actually REDUCE your risk.

- STOR’s business moat is more durable and stronger than the REIT industry average.

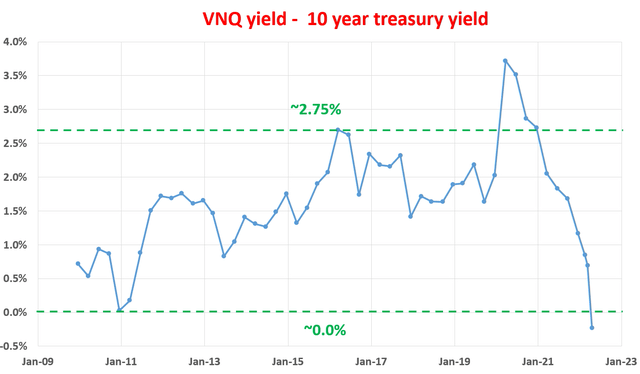

- Finally, despite solid fundamentals, STOR also has a much more attractive valuation. Especially when assessed in the context of risk-free rates, the VNQ yield spread is near a decade low, signaling the worst time to buy in a decade.

VNQ and STOR: basic information

We assume that most readers are already familiar with VNQ. It is one of the most popular and largest ETF REIT funds. He owns around 180 REIT stocks in the US and charges a low expense ratio of 0.12%. As a REIT fund, it offers a current dividend yield of around 2.7%, almost more than 2x the yield compared to the broader market. Although the yield should be properly interpreted in the context of Treasury rates, as will be developed in a later section.

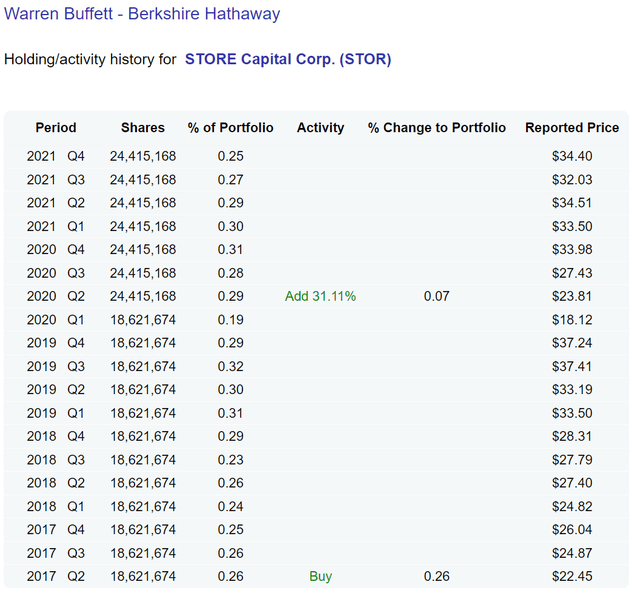

As for STOR, it is one of the largest and fastest growing net rental REITs in the United States. He has a large, well-diversified portfolio of investments in over 2,500 properties across the United States. just over $0.8 billion at the time of this writing. It’s not the largest component of his mammoth portfolio, but it represents about 10% of the total outstanding STOR shares – a strong endorsement of STOR in my opinion.

Source: DataROMA

Don’t confuse diversification with diworsification

This first cornerstone of buffettism is concentration. Don’t overemphasize the importance of diversification, and don’t diversify just to diversify.

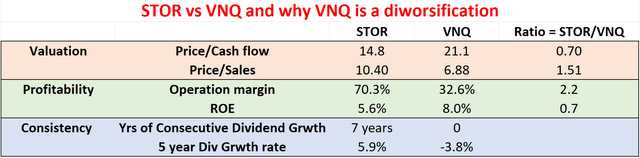

As you can see from the next two charts, compared to STOR, the REIT sector (represented by VNQ) is really a diworsification. Note that the first chart is based on data provided by either Yahoo Finance or Seeking Alpha around 10:00 a.m. on April 22, 2022. Given the high volatilities these days, these numbers may have changed a bit as you read this article. Some highlights of this comparison:

- STOR offers greater profitability, consistency and valuation than VNQ. Its price/cash flow ratio is 30% lower than the sector average. And don’t worry about STOR’s higher price-to-sales ratio. Considering that its operating profit margin is almost double the industry average, STOR’s price-to-sales ratio is actually lower.

- In particular, if we use dividends as a proxy for returns to owners, STOR currently provides a yield of around 2.4% above VNQ (5.1% vs. 2.7% and more later).

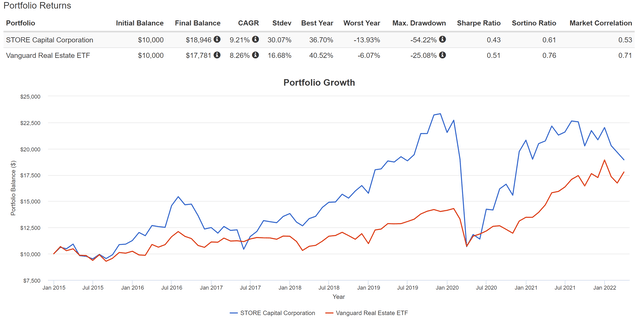

Author Source: www.portfoliovisualizer.com

Choose companies with a sustainable moat

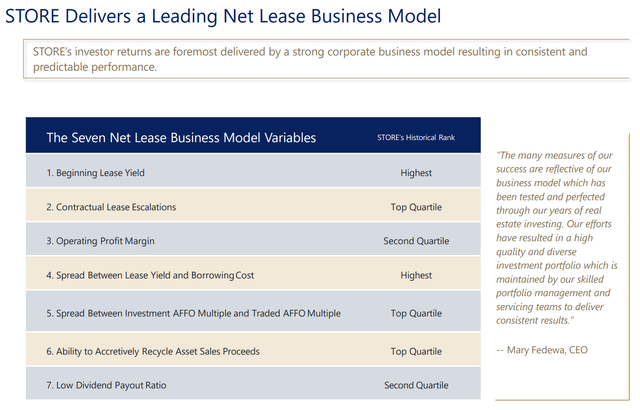

Thanks to its size and strong business model, STOR enjoys a higher moat than the REIT industry average. As the following graph shows, the quality of STOR’s business is among the best in its industry in many respects. Of the seven key business metrics for the net rental industry, STOR’s numbers are either the highest or in the industry’s first quarter. In particular, it benefits from the highest initial lease yield and the spread between lease yield and cost of borrowing among its peers. Its contractual lease escalation, split between the investment AFFO multiple and the traded AFFO multiple, and its ability to accretively recycle proceeds from asset sales are among the highest quartiles in the industry.

Because of these superior fundamentals, as shown in the chart above, STOR investors have been generously rewarded in the past with a combination of earnings growth, valuation expansion and dividends. The stock has generated 189% of total return since its IPO and outperforms the VNQ sector by a good margin (around 177% of total return).

Source: STOR Investor Presentation

Always be value-driven

No matter how good the business, buying it at a bad valuation can lead to losses. In particular, Buffett himself has repeatedly pointed out that interest rates act as gravity on any asset valuation, and valuation must always be interpreted in the context of interest rates.

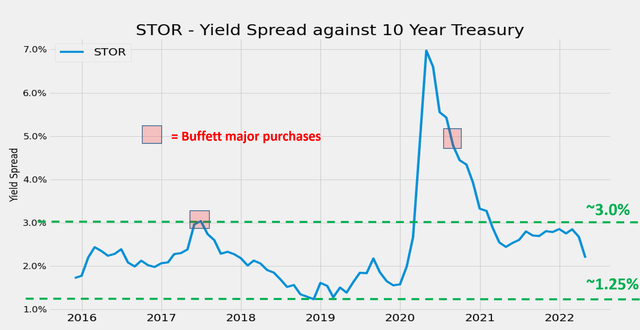

For bond-like stocks like STOR, an effective way to gauge their valuation with adjusted interest rates is to calculate the yield spread. The details of the yield spread calculation were provided in our previous article on LOW (another stable dividend stock). Yield spread is an indicator that we check first, and we have fortunately had very good success with this indicator due to:

- PE or current price/cash flow multiples provide partial or even misleading information due to the differences between accounting results and owners’ results.

- Dividends provide a back door to quickly estimate owners’ income. Dividends are the most reliable financial information and the least subject to interpretation. In investing, we always prefer a simpler method that relies on fewer unambiguous data points than a more complicated method that depends on more ambiguous data points.

- The dividend yield spread (“YS”) is based on timeless intuition. No matter how times change, the spread ALWAYS provides a measure of the risk premium investors are paying over risk-free rates. A large gap provides a higher margin of safety and vice versa.

Against this backdrop, you will see below that once adjusted for interest rates, STOR’s current valuation is even more attractive than on the surface.

The first chart below shows the yield spread between STOR and the 10-year Treasury note. The yield spread is defined as STOR’s TTM dividend yield minus the 10-year Treasury bond rate. As can be seen, the spread is limited and treatable. The spread has been between about 1.25% and 3.0% most of the time, which makes sense for a stable and mature company like STOR. Which suggests that when the spread is near or above 3%, STOR is significantly undervalued relative to 10-year treasuries (i.e. I would sell treasuries and buy STOR) . In this case, the sellers of STOR are willing to sell it to me (again essentially a capital bond) at a yield 3% higher than a risk-free bond. So it’s a good deal for me. And you can clearly see the screaming buy signal during the pandemic panic selling of 2017 and 2020 when the yield spread rose to be near or above 3% – precisely the times Buffett bought.

And at the time of this writing, the yield gap is around 2.2%. Despite recent spikes in Treasury yields, it still sits near the thicker end of the historical spectrum. In our view, Treasury yields are already close to their long-term targets. But either way (that is, if we are wrong), such a yield gap signals very manageable valuation risks for STOR and also provides a comfortable cushion against further interest increases.

Author

In contrast, the picture for VNQ is completely different and much more concerning. As you can see, as 10-year Treasuries rallied towards 3%, this pushed the yield differential between VNQ and risk-free rates to the thinnest level in a decade. Again, the spread is limited and treatable most of the time as expected. The spread has been between roughly ~0% and 2.75% the majority of the time over the past decade. And at the time of this writing the spread is around NEGATIVE 0.2% as you can see. It’s the thinnest level in a decade.

Indeed, according to our Market Sector Dashboard (you can also download it using this link), the REIT sector is currently among the most overvalued sectors.

Author

Risks

There are, however, a few risks associated with STOR.

First, STOR (like any other typical REIT business) relies on debt financing and is therefore somewhat sensitive to changes in interest rates.

Second, the ongoing pandemic is also a risk. STOR has tenants that are directly exposed to the pandemic, such as restaurants, theaters and health clubs.

Third, Volk’s recent departure. STOR Founder and Executive Chairman Chris Volk recently announced that he will be stepping down as Chairman of the Board and as a board member or director of any affiliated company. Volk has been a successful serial entrepreneur, and he must be a key factor in Buffett’s investment decision. His departure creates uncertainty in the direction and management of STOR.

Conclusions and final thoughts

A comparison between STOR and VNQ illustrates the cornerstones of buffettism. Specifically,

- Don’t overemphasize diversification and VNQ represents a diworsification over STOR. STOR offers superior profitability, consistency and valuation compared to the REIT represented by VNQ.

- Don’t be stock pickers, be business pickers. If you stay within your circle of expertise and understand the fundamentals of the stocks you choose, fewer holdings not only lead to better returns, but also to REDUCE your risk.

- Finally, always be value-oriented and anchor valuation in the context of risk-free rates. Our market sector dashboard shows that the overall REIT sector is currently among the most overvalued sectors. The spread between the VNQ and the 10-year Treasury yield is NEGATIVE at 0.2% currently, the thinnest level in a decade. While the yield spread between STOR and the Treasury yield is around 2.2%, near the middle of its historical spectrum, signaling very manageable valuation risks ahead and also providing a comfortable cushion against further interest increases.