Airline Sealed SEE is expected to release its first quarter 2022 results on May 3, before the opening bell.

First quarter estimates

Zacks’ consensus estimate for first-quarter revenue is pegged at $1.39 billion, suggesting 10% growth from the figure reported a year ago. Zacks’ consensus estimate for quarterly earnings currently stands at 92 cents per share, pointing to 18% year-over-year growth.

Fourth quarter performance

Sealed Air’s fourth quarter 2021 earnings and sales were up year over year. While revenue topped Zacks’ consensus estimate, earnings missed the same. The company has an earnings surprise for the last four quarters of 2.9% on average.

Sealed Air Corporation award and EPS surprise

Sealed Air Corporation price-eps-surprise | Quote Sealed Air Corporation

What the Zacks model indicates

Our proven model conclusively predicts increased profits for Sealed Air this season. The combination of a positive Earnings ESP and a Zacks rank of #1 (Strong Buy), 2 (Buy), or 3 (Hold), increases the odds of beating Earnings.

You can discover the best stocks to buy or sell before they’re flagged with our earnings ESP filter.

ESP Earnings: Sealed Air has a gain ESP of +1.09%.

Zacks Rank: Sealed Air is currently wearing a Zacks rank #3. You can see the full list of today’s Zacks #1 Rank stocks here.

Key Factors to Note

Sealed Air’s performance in the first quarter likely benefited from strong demand for food, beverage and healthcare packaging and booming e-commerce business. Approximately 62% of the company’s revenue is generated from the packaging of proteins, foods, fluids and goods for the medical and life science industries, while online sales contribute nearly 12%.

In December 2018, Sealed Air announced a reform plan called Reinvent SEE Strategy along with a new restructuring program to drive growth and profits. The strategy focuses on innovations, SG&A productivity, product profitability, channel optimization and improved customer service. The capabilities, operational disciplines and governance processes established as part of the Reinvent SEE business transformation are now integrated into the company’s continuous productivity improvement system, SEE Operating Engine. Savings from these initiatives are likely to have boosted operating margin performance in the March quarter. However, rising raw material and freight costs may have weighed on the company’s performance in the quarter to report.

Sector estimates

Zacks’ consensus estimate for first-quarter food segment net sales is set at $782 million, suggesting growth of 11% over the prior-year period. Zacks consensus estimate for segment adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) is set at $173 million, indicating a 10% increase from year-quarter levels previous. The segment likely saw increased demand for foodservice as restaurants and other public places reopened, as well as strong demand for automated equipment solutions.

Zacks’ consensus estimate for first-quarter protective packaging segment net sales is pegged at $606 million, indicating a 7% year-over-year improvement. Zacks’ consensus estimate for the segment’s adjusted EBITDA is $114 million, suggesting growth of 4% over the figure reported the previous year. The segment’s medical and life sciences portfolio continues to benefit from strong demand for medical supplies, pharmaceuticals and personal protective equipment, coupled with increased demand for temperature guaranteed packaging solutions.

Continued growth in e-commerce and fulfillment and increased demand in industrial end markets may have boosted reportable segment performance in the quarter. Strong demand for automated equipment and sustainable packaging solutions continues to fuel growth in the food and protected packaging segments.

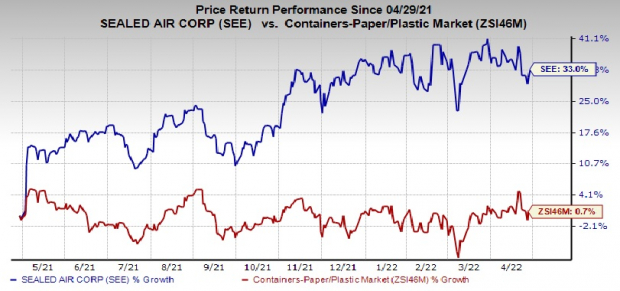

Price performance

Image source: Zacks Investment Research

Over the past year, Sealed Air shares have gained 33% against industry growth of 0.7%.

Other stocks set to beat earnings estimates

Here are a few other Industrials stocks worth considering, as our model shows that these also have the right combination of elements to beat on earnings in their upcoming releases.

Eaton Company ETN has a +0.85% Earnings ESP and a #3 Zacks Rank. Zacks’ consensus estimate for the company’s revenue of $4.81 billion for the first quarter of 2022 indicates year-over-year growth of 2.6%.

Zacks’ consensus estimate for the company’s earnings for the first quarter of 2022 currently stands at $1.60, suggesting 11% year-over-year growth. ETN earnings have exceeded the consensus mark in each of the past four quarters, with the average surprise being 7%.

Deere & Company DE currently has an earnings ESP of +0.74% and a Zacks ranking of 2. The Zacks consensus estimate for Deere’s second-quarter fiscal 2022 earnings is set at $6.65 per share, suggesting 17% growth over the prior year quarter.

Zacks’ consensus estimate for its quarterly revenue is $13.4 billion, suggesting 22.2% year-over-year growth. Deere has a four-quarter earnings surprise of 20.6% on average.

Illinois Tool Works Inc. ITW currently has a +0.46% Earnings ESP and a #3 Zacks rank. Zacks’ consensus estimate for Illinois Tool’s first-quarter 2022 earnings is currently pegged at $2.07 per share, unchanged in the past 30 days. The projection indicates a decline of 1.9% compared to the count of the quarter of the previous year.

Zacks’ consensus estimate for Illinois Tool’s quarterly revenue is pegged at $3.7 billion, indicating a 6.3% year-over-year improvement. ITW has a four-quarter earnings surprise of 3.7% on average.

Stay on top of upcoming earnings announcements with Zacks Earnings Calendar.

7 best stocks for the next 30 days

Just Released: Experts distill 7 elite stocks from the current Zacks No. 1 Ranking 220 Strong Buys list. They consider these tickers “most likely for early price increases.”

Since 1988, the full list has beaten the market more than 2 times with an average gain of +25.4% per year. So be sure to give these handpicked 7 your immediate attention.

Discover them now >>

Click to get this free report

Illinois Tool Works Inc. (ITW): Free Inventory Analysis Report

Eaton Corporation, PLC (ETN): Free Stock Analysis Report

Deere & Company (DE): Free Inventory Analysis Report

Sealed Air Corporation (SEE): Free Inventory Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.