Big brick-and-mortar retailers may push back competition from online retailers Amazon.com Inc. continuing to offer curbside pickup and other contactless delivery services that are set to grow in the coming years, according to industry experts.

According to the latest data from eMarketer, US sales of click-and-collect services are expected to reach over $100 billion in 2022, up from $83.47 billion in 2021 and $72.46 billion in 2020.

Click-and-collect services allow consumers to purchase pronline products and PhotoStore items in the store or in a designated area such as a locker, kiosk or parking lot. Demand for these services has increased dramatically during the pandemic as they allow US consumers purchase goods while minimizing physical contact.

Retailers that offer these services, such as Walmart Inc., Target Corp., Home Depot Inc., and Best Buy Co. Inc., have a significant competitive advantage on Amazon thanks to their large store footprints, said Andrew Lipsman, principal analyst at eMarketer.

“I think these four companies, in particular, are very well positioned for what will likely be one of the key behaviors that will impact the pandemic,” Lipsman said.

Amazon has more than 500 Whole Foods Market Inc. locations and is developing a new grocery store concept, but it will take Amazon years to create the kind of store footprint that could rival the click-and-collect space with the retail business. leaders, Lipsman said.

Buying pickup services online is nothing new. Some brick-and-mortar retailers started offering the service a decade ago, in part to better compete with Amazon.

But retailers have ramped up those services in response to the pandemic as shelter-in-place orders have rolled out across the country. Best Buy has pivoted to a Q1 curbside contactless model and I saw a increased demand in categories such as computing, games and small appliances. The Home Depot has expanded its free curbside pickup service to most stores as an extension of its online buy/pick up in store option, while Walmart has expanded its pickup and delivery service capacity. Target’s Order Pickup service grew more than 50% in the third quarter, while the company’s Drive Up service grew more than 500%.

Consumers may eventually return to stores throughout their shopping journey as COVID-19 vaccinations roll out, but contactless options have become a convenient alternative for in-store shopping, especially in areas such as l groceries and home improvement, said David Gilvice president of insights and analytics at Rakuten Intelligence.

Consumers now know they can rely on pick-up delivery methods as retailers have continued to improve fulfillment and offer substitutions for out-of-stock products, he said.

“Consumers aren’t going to go back,” Gill said. “If the experience improves and I don’t get the wrong brand or the wrong size, then it’s just going to take root.”

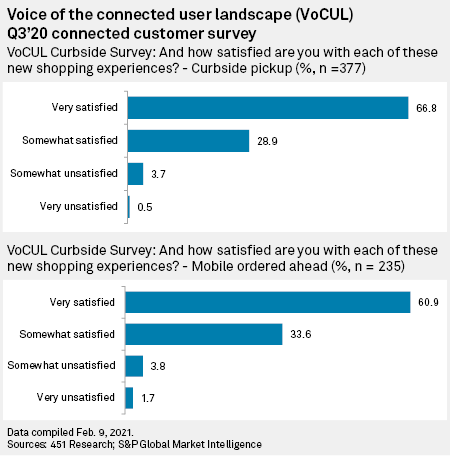

The majority of consumers seem satisfied with curbside pickup. According to the latest “Voice of the Connected User Landscape” survey from 451 Research, nearly 67% of respondents who tried curbside pickup services for the first time said they were very satisfied with the experience. Nearly 29% say they are rather satisfied, while 3.7% say they are rather dissatisfied. Meanwhile, more than 60% of survey respondents who tried a mobile pre-order service for the first time said they were very satisfied. This service would include ordering Starbucks coffee online and then picking it up at the store, for example.

Still, curbside pickup isn’t necessarily a slam dunk for retailers, said Sheryl Kingstone, head of customer experience and commerce research at 451. She noted that there’s still a large portion of consumers who are ambivalent about these services.

Specific use cases for curbside pickup may become more apparent over time, said Jordan McKee, research director at 451. Consumers may take advantage of the service for reasons other than minimizing contact during the pandemic, including avoiding long lines during holidays or bad weather, he said.

“You’ll start to see some of these specific use cases for sidewalk with consumers who might have tried it for the first time out of longer-term necessity as the virus recedes,” he said. .

451 The research is part of S&P Global Market Intelligence.