3D_generator

Just before the New Year, I identified Life Storage Inc. (New York Stock Exchange: LSI) among the 16 REITs likely to outperform in 2022.

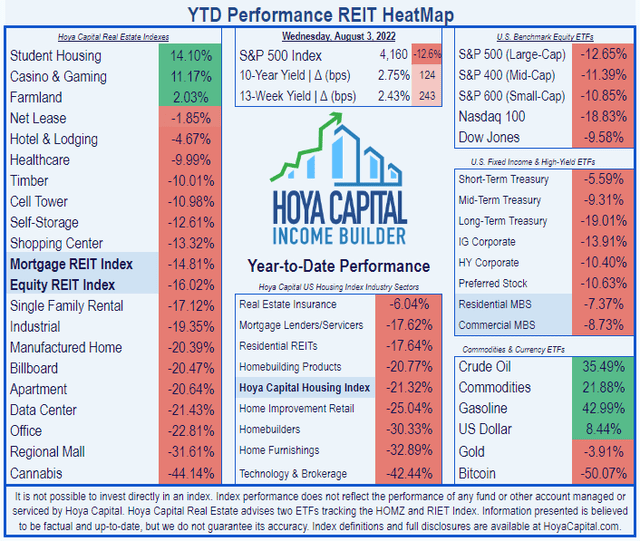

According to Hoya Capital Income Builder, storage REITs in general have slightly outperformed the REIT average, despite the leak to high yield securities triggered by record inflation.

Income Builder Hoya Capital

LSI shares lost (-15.37%) year-to-date and thus slightly outperformed the overall REIT average, while underperforming the storage REIT sector.

Looking for Alpha Premium

The year is only half over and I expect LSI stocks to do even better in the second half than in the first. Why?

Meet the company

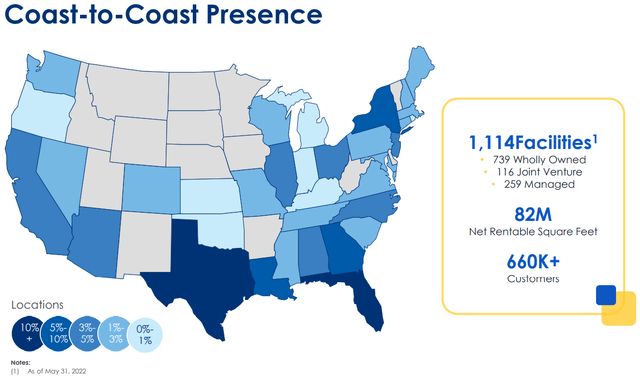

I did deep dives on LSI in December and again in May, and these articles contain many details about the company itself. For the purposes of this article, suffice it to say that the company operates over 1,000 stores in 36 states, concentrated more in the southern half of the United States.

Presentation to the company’s investors

LSI differentiates itself from other storage REITs with two innovations it pioneered:

- online and contactless self-service rentals (currently around 35% of all rentals) and

- storage for e-commerce (their “Warehouse Anywhere” program)

more

- extensive use of third-party management (which increases revenue without increasing debt burden, increases acquisition pipeline by helping to identify more profitable off-market opportunities, improves operational decision-making by capturing more customer data and increases awareness of the LSI brand), and by

- a significant commitment to joint ventures (which generates higher returns due to the collection of fees in addition to equity, includes all the benefits of third-party management listed above; and reduces business risk from ‘acquiring newly built facilities in the early stages of leasing) .

LSI does not build its own storage facilities, so the pace and capitalization rate of acquisitions is key to their success.

Quarterly results are in

The company just released second quarter 2022 results after the August 3 closing bell, and here’s what they show:

- The occupancy rate rose to 94.0%, compared to 92.4% at the start of the year.

- Realized rental rates increased 20.0% year over year (year over year).

- Same-store NOI (net operating income) of $135.7 million, up 25.4% year-on-year. This included double-digit growth in 32 of its 33 major markets.

- Acquisition of 13 additional stores for a total investment of $262.6 million, with contracts to purchase 7 more for an additional $137.4 million.

- Added 17 more stores to its third-party management platform, bringing the total to 385.

- Full-year FFO forecast increased from $6.09 mid-term to $6.30.

- Same-store NOI forecast increased 350 basis points from 13.5% at the midpoint to 17.0%.

- Raising guidance for wholly-owned acquisitions by 12.5%, from $800 million at midterm to $900 million.

- Joint venture investment forecast increased 33.3% from $75 million mid-term to $100 million.

The company does not provide any cap rate figures, but the pace of acquisitions this year is exceeding expectations. Given the fragmented nature of the storage industry, many opportunities most likely continue to present themselves.

Growth indicators

Here are the 3-year growth numbers for FFO (Funds From Operations), TCFO (Total Cash From Operations) and Market Cap.

| Metric | 2019 | 2020 | 2021 | 2022* | CAGR over 3 years |

| FFO (millions) | $266 | $277 | $400 | $531 | — |

| FFO growth % | — | 4.1 | 44.4 | 32.8 | 25.9% |

| FFO per share | $3.75 | $3.97 | $5.07 | $6.30 | — |

| % growth in FFO per share | — | 5.9 | 27.7 | 24.3 | 18.9% |

| TCFO (millions) | $279 | $299 | $434 | $557 | — |

| % growth in TCFO | — | 7.2 | 45.2 | 28.3 | 25.9% |

* Projection, based on H1 2022 figures; Source: TD Ameritrade, CompaniesMarketCap.com and author’s calculations

You just don’t see growth numbers like this every day. LSI remains a true FROG (Fast Rate of Growth REIT), with double-digit growth and a rock-solid balance sheet.

At $10.5 billion, LSI sits slightly above the market cap sweet spot, which is the second-best place to be. At the start of 2019, the market cap was $4.33 billion, so the 3.5-year market cap growth rate for this company is 28.8%.

In the meantime, here’s how the stock price has performed over the past 3 twelve-month periods, compared to the REIT average represented by the Vanguard Real Estate ETF (VNQ).

| Metric | 2019 | 2020 | 2021 | 2022 | CAGR over 3 years |

| LSI stock price on August 2 | $67.07 | $65.42 | $117.80 | $122.33 | — |

| LSI Stock Price Gain % | — | (-2.5) | 80.1 | 3.8 | 22.18% |

| VNQ stock price on August 2 | $89.32 | $81.39 | $106.06 | $96.90 | — |

| VNQ Share Price Gain % | — | (-8.9) | 30.3 | (-8.6) | 2.75% |

Source: MarketWatch.com and author’s calculations

LSI was only slightly impacted by the COVID sell-off, largely due to the introduction of contactless self-service rentals. Then the company was one of the leaders in the REIT boom of 2021, with a phenomenal return of 80.1%. LSI has significantly outperformed VNQ in each of the past three twelve-month periods and has rewarded investors with an average gain of 22.18%, compared to just 2.75% for VNQ. There is every reason to believe that the outperformance will continue.

Balance sheet metrics

Here are the main balance sheet indicators. LSI’s investment-grade balance sheet boasts a FROG-worthy 2.15 liquidity ratio, with a debt-to-equity ratio of just 18% and a debt-to-EBITDA ratio of 5.4.

| Company | Liquidity rate | Rate of endettement | Debt/EBITDA | Bond rating |

| LSI | 2.15 | 18% | 5.4 | BBB |

Source: Hoya Capital Income Builder, TD Ameritrade and author’s calculations

As of June 30, 2022, the Company had approximately $32.6 million in cash and approximately $197 million available on its line of credit, for a total of $230 million in dry powder for acquisitions. The company also refinanced its bank credit facility which was due to mature on March 10, 2023, from $500 million to $1.25 billion, through January 2027.

Dividend Indicators

In July, LSI announced a further 8% annual dividend increase, bringing the 3-year dividend growth rate to 17.4%, more than doubling the Storage REIT average and nearly tripling the overall REIT average. With an above-average current yield of 3.53%, unusual for a storage REIT, this translates to an exceptional dividend score of 4.87. LSI continues to put more and more money in the pockets of investors over the years. On the contrary, the dividend is a bit too safe, with a B rating from Seeking Alpha Premium.

| Company | Div. Yield | Div. 3 years Growth | Div. Score | Payment | Div. Security |

| LSI | 3.53% | 17.4% | 4.87 | 70% | B |

Source: Hoya Capital Income Builder, TD Ameritrade, Seeking Alpha Premium

Dividend Score projects the yield three years from now, on stocks bought today, assuming the rate of dividend growth remains unchanged.

Evaluation Metrics

Such dramatic growth usually comes at a high price, but not with LSI. This year’s sell-off put the price/FFO at 20.2, nearly dead even with the REIT average, as did the 4.5% discount to NAV. It is an attractive entry price.

| Company | Div. Score | Price/FFO ’22 | Premium to NAV |

| LSI | 4.87 | 20.2 | (-4.5%) |

Source: Hoya Capital Income Builder, TD Ameritrade and author’s calculations

What could go wrong?

LSI runs the same risks as any other company that relies on acquisitions for external growth, because these acquisitions do not always prosper as expected. Changes in interest rates may affect their ability to acquire or finance new properties or redevelop existing sites, or may remove rate caps.

The REIT storage industry is fiercely competitive, with several strong players, including National Storage Affiliates, especially in Sun Belt’s prized markets. Increased competition for deals could also lower capitalization rates on new acquisitions.

Self-storage units are relatively easy to build, and oversupply from the industry could dampen rental growth. So far, however, the offer doesn’t seem to be catching up.

Investor conclusion

Double-digit growth in revenue, cash flow, share price and dividend growth, sustained for 3 consecutive years, with no signs of slowing down anytime soon, all at a more than fair price. This is what LSI offers investors. For long-term investors, this company is as close to a slam dunk as it gets. I rate this company as a strong buy. In the short term, I wouldn’t be surprised if the broader REIT market pulls back significantly before hitting all-time highs this year or next.

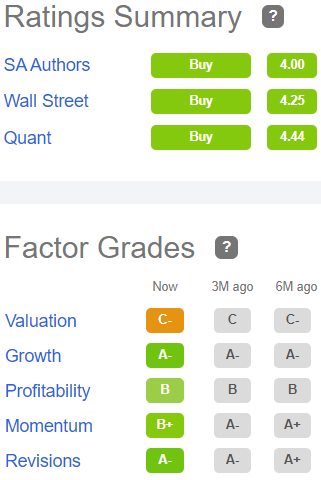

Looking for Alpha Premium

Buy appears to be the consensus of Wall Street analysts, as well as Seeking Alpha Quant and The Street ratings. TipRanks and is neutral, and Zack’s says Hold. The company has achieved a return on equity of 9.15% and asset growth of 37.09% over the past 12 months.