The first quarter of 2022 has undoubtedly been difficult, exhausting both investors and businesses.

Sitting in a very unique economic situation after emerging from an unprecedented pandemic, we have seen the Fed pivot to a more hawkish nature, raising borrowing rates to mitigate levels of inflation not seen in decades.

Geopolitical issues, supply chain bottlenecks and soaring energy costs have undoubtedly added fuel to the fire. Nonetheless, the Fed remains confident in its “soft landing” plan and believes the economy should thrive in the face of less accommodative monetary policy.

Time will tell, as we will have to wait and see if the Fed’s plan can materialize.

Overall, the market continues to roll, giving investors no chance to breathe. On a more positive note, the indices are still well above their 2022 lows, which bodes well. The five-year chart below shows that the S&P 500 has rebounded from March 2021 levels.

Image source: Zacks Investment Research

Perhaps the rebound has already begun – something all market players can celebrate.

During the first quarter of 2022, investors witnessed double-digit valuation declines following numerous earnings releases. Reports revealed that many companies experienced margin compression, which negatively impacted quarterly results.

One company set to report quarterly results after Thursday’s bell is tech player DocuSign (DOCUMENT – free report). Founded in 2003 and based in San Francisco, DocuSign is a global cloud-based software provider.

Let’s see how the company forms in the report.

Performance and valuation of shares

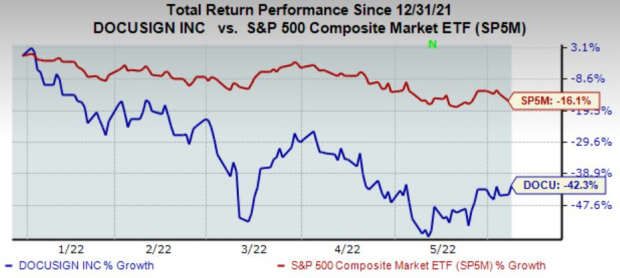

Year-to-date, DocuSign shares have fallen in the market, losing 42% of their value and easily underperforming the S&P 500, although they have also fallen significantly. Throughout 2022, tech stocks have been hit hard – and DocuSign is no exception.

Image source: Zacks Investment Research

Extending the time frame over the past year, we can see that DocuSign stocks have struggled tremendously to gain a foothold. Stocks fell in early December 2021 after tracking the S&P 500.

Image source: Zacks Investment Research

The poor performance of equities is concerning, as it shows that the buyers have fully retreated, leaving the bears to advance freely. However, it’s crucial to note that there has been a significant lack of buyers across all technologies over the past few months – not just DocuSign.

DocuSign’s current forward price-to-sales ratio sits at 6.8X, which could be considered a bit pricey. However, the value is nowhere near 2020 highs of 37.5X and is a fraction of its median of 13.5X. Additionally, the current value represents a hefty 67% premium to the S&P 500 value of 4.1X.

Image source: Zacks Investment Research

Earnings return

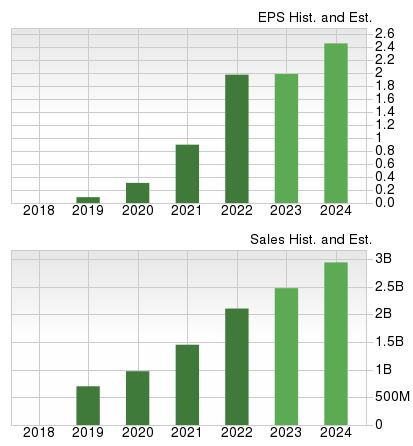

The company reported strong earnings results, beating net profit estimates in nine of the previous ten quarters. In its last four quarterly releases, the company has average double-digit EPS surprise of 27%, and in its most recent quarter, DocuSign reported results in line with expectations.

Sales numbers have also been consistently strong, stringing together 14 consecutive sales beats dating back to April 2018. In its most recent quarter, DOCU reported quarterly revenue of $580 million, which is easy enough to beat. Zacks Consensus Sales estimate of $560 million by 4%.

Estimates

Analysts mostly left their earnings estimates unchanged for the past 60 days. For the next quarterly release, the EPS estimate of $0.46 shows a respectable 4.5% expansion in net income from the prior year quarter.

Looking a bit forward, earnings are expected to be flat year-over-year in the current fiscal year, but net income is expected to grow 25% in FY24.

Revenue looks strong as Zacks Consensus’ sales estimate of $581 million for the quarter shows a considerable 24% expansion in revenue from quarterly sales of $469 million a year ago. a year. Additionally, revenue is expected to increase by 17.5% in FY23 and an additional 19% in FY24.

Image source: Zacks Investment Research

Microsoft Azure

For investors interested in exposure to cloud computing, like what DOCU provides, a solid bet in the industry is Microsoft (MSFT – free report).

MSFT’s cloud computing service is called Microsoft Azure. It’s the only consistent hybrid cloud, delivering unparalleled developer productivity and comprehensive multi-layered security.

Microsoft’s Azure cloud platform led the way in a strong performance in its latest quarterly report. It saw above-expected commercial bookings growth of 28% and Azure Cloud revenue was $23.4 billion, up 32% year-over-year.

MSFT is convinced that cloud technology will be a key driver of growth in global economic output.

MSFT is currently a Zacks Rank #3 (Hold).

Conclusion

The poor performance of equities raises red flags. However, the entire technology was taken down, not just DocuSign.

Valuation levels have been lowered, but they still look expensive. Additionally, DocuSign is seeing increased spending as it invests in sales, marketing, and technical expertise. Total operating expenses of $1.3 billion were up 35% year-over-year in fiscal 2022, indicating that bottom line will likely remain under pressure going forward.

As with most technology, I think investors benefit from exercising caution ahead of the quarterly release. Instead, if quarterly results are strong, investors should slowly start positioning themselves using an average dollar cost strategy.

:quality(70):focal(-5x-5:5x5)/cloudfront-ap-southeast-2.images.arcpublishing.com/tvnz/DKFZZFK4DJGQ7EWCOZZ4B7CCCQ.jpg)