An Auckland liquor store that sparked community outrage for offering Afterpay has said it will no longer let customers buy alcohol using the buy now, pay later service.

Bottle-O Panmure store owner Ketankumar Satpute said he faced online vitriol after posting about Afterpay on his Facebook site when other liquor stores were already accepting Afterpay.

Afterpay has defended its expansion into alcohol sales financing, but the move did not impress Trade and Consumer Affairs Minister David Clark, who said he had done nothing to establish social license to buy now, pay later (BNPL).

On Friday night, Bottle-O Panmure said in a Facebook post that it was reviewing its policies and, until further notice, Afterpay would not be accepted as a form of payment in the store.

READ MORE:

* The secret “buy now, pay later” code of conduct that you are not allowed to see

* Government considers regulating ‘buy now, pay later’ lenders

* Consumer: Buyers pay $10 million in late fees to buy now and pay later

Clark decides whether buy now, pay later loans should be subject to laws governing other forms of lending, including responsible lending rules.

Natalie Vincent, chief executive of the Ngā Tāngata microfinance program, which helps people escape unaffordable debt, was horrified that Afterpay was expanding to fund alcohol sales.

“Bottle-O Panmure is flanked by pawnshops on either side with a high cost moneylender and another pawnshop just down the street,” she said.

“I think it paints a picture of the economic conditions for many people in this community and i.e. marginalized, struggling, financially excluded and targets for high cost predatory lenders and now Afterpay, to buy l ‘alcohol.

Christians Against Poverty is calling on the government to require ‘buy now, pay later’ lenders to be responsible and do credit and accessibility checks before lending.

“Allowing this to be offered in a community ravaged by poverty and all the social problems that come with it is abhorrent,” she said.

After posting on Afterpay, Bottle-O Panmure was subjected to a flood of angry messages as the news spread.

Marlon Marly McLean posted: “Get drunk, get hungover and you ‘literally’ pay for it weeks later!

Provided

Natalie Vincent, Managing Director of Ngā Tangata Microfinance, is appalled that alcohol is purchased using Afterpay, buy now, pay later.

Nicole and Glen Woodford posted: “No no no!!!!! It’s such a bad addiction that real people are waking up…alcohol ruins more lives than most drugs I know!

“Everyone is targeting me because I just started,” Satpute said.

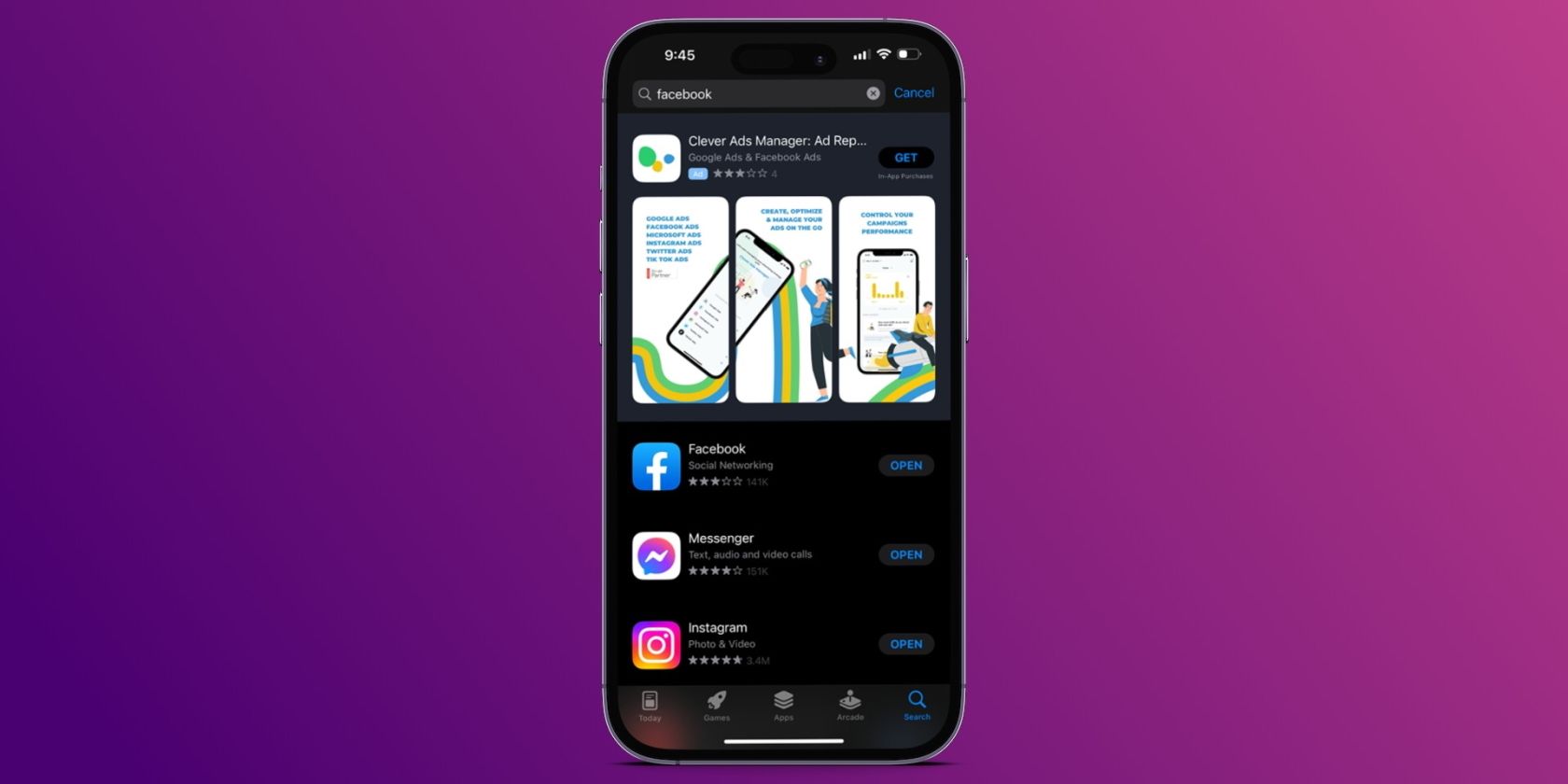

screenshot

Bottle-o Panmure’s Facebook ad offering alcohol sales with Afterpay buy now, pay later loans has caused a backlash.

A spokesperson for Afterpay said Bottle-O Panmure was one of its first liquor retailers.

Other liquor retailers listed on the Afterpay website include Thirsty Liquor Tauranga, Premium Liquor, Merchants Liquor Queenstown and Containerdoor.

The spokesman said people have been buying alcohol with credit cards, which can incur interest of more than 20%, for decades.

“Afterpay has stronger consumer safeguards than credit cards, which in turn drive positive consumer outcomes,” the spokesperson said.

Vincent said that to get a credit card, people had to submit to credit checks, which was not the case with all buy now, pay later lenders.

Fincap Budget Mentoring Services submitted a submission to Clark’s Lending Laws Review highlighting the case of a single mother surviving on benefits, who had loans with six different BNPL lenders. The rent took 60% of his income. BNPL companies took another 30%, leaving him no money for food and electricity.

Another single mother had 12 BNPL loans, Fincap said.

Vincent asked Clark to require BNPL lenders to carry out affordability checks before issuing loans.

ROBERT KITCHIN/Stuff

Trade and Consumer Affairs Minister David Clark is considering regulating buy now, pay later loans.

Clark did not elaborate on whether the BNPL would be regulated like other forms of lending, but said, “I believe affordability should be at the heart of lending decisions.”

Officials from the Department of Business, Innovation and Jobs found that 20% of BNPL users had missed payments and 9% had delayed paying other bills because they had accumulated debt. BNPL loans.

Afterpay has not increased its business’s commerce, Satpute said.

“It hurts me because no one comes to my store.

“We have been struggling for three years in terms of money. We don’t get support from the government,” he said.