Alpha metallurgical resources AMR is expected to release its first quarter 2022 results on May 5, before the opening bell.

First quarter estimates

The Zacks consensus estimate for Alpha Metallurgical Resources’ first-quarter revenue is currently pegged at $876 million, suggesting 127% year-over-year growth. The earnings consensus mark currently stands at $18.49 per share, unchanged in the past 30 days. The consensus mark points to turnaround performance from a loss per share of $1.78 in the first quarter of 2021.

Fourth quarter performance

In the fourth quarter, Alpha Metallurgical reported year-over-year improvement in revenue and profit. The company beat the Zacks consensus estimate on the top and bottom results. The company has a negative surprise of 58.2% on average over the last four quarters.

Alpha Metallurgical Resources, Inc. EPS Awards and Surprise

Alpha Metallurgical Resources, Inc. price-eps-surprise | Alpha Metallurgical Resources, Inc. Quote

Factors to note

Alpha Metallurgical’s first quarter results are expected to reflect continued strength in coal markets and strong global price momentum. Coal prices throughout the quarter were supported by soaring demand amid shortages of alternative energy products and sanctions on Russian coal. Markets were already tight even before Russia’s invasion of Ukraine, as the energy crisis and soaring natural gas prices in Europe and Asia in late 2021 boosted the use of coal for power generation . Higher realized prices may have contributed to AMR’s top performance in the quarter ahead.

While prices for its products remain high, AMR has seen an increase in the cost of coal sales, particularly for royalties and taxes directly linked to the sale price. On top of that, inflationary pressure and rising labor costs added pressure on margins in the reportable quarter. The company has reduced its level of debt, which should have led to lower interest charges. This, along with the company’s efforts to control costs and improve productivity, may have negated the impact of high costs and helped margins in the first quarter.

What the Zacks Model Reveals

Our proven model does not conclusively predict an earnings beat for Alpha Metallurgical Resources this time around. The combination of a positive Earnings ESP and a Zacks rank of #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of beating Earnings. But it is not the case here. You can see the full list of today’s Zacks #1 Rank stocks here.

You can discover the best stocks to buy or sell before they’re flagged with our earnings ESP filter.

ESP Earnings: The PSE of earnings for Alpha Metallurgical Resources is 0.00%.

Zacks Rank: AMR currently carries a Zacks rank of 1.

Price performance

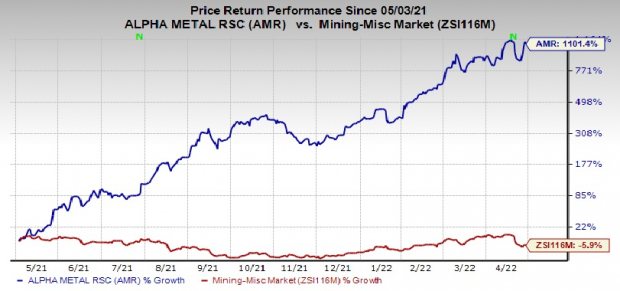

Image source: Zacks Investment Research

Shares of Alpha Metallurgical Resources have soared 1,101.4% over the past year, compared to a 5.9% decline for the industry.

Stocks set to beat estimates

Here are some stocks you can consider as our model shows that they have the right combination of elements to show a rhythm of profits in their next releases:

Olympic steel ZEUS has a +6.64% Earnings ESP and a #1 Zacks Rank. Zacks’ consensus estimate for the company’s revenue of $548 million for the first quarter of 2022 indicates year-over-year growth of 18.4%.

Zacks’ consensus estimate for the company’s Q1 2022 earnings currently stands at $2.26, suggesting a 14.7% year-over-year improvement. ZEUS has a four-quarter earnings surprise of 49.6% on average.

Cigna CI currently has an earnings ESP of +6.26% and a Zacks ranking of 2. The Zacks consensus estimate for CI’s quarterly revenue is $43.6 billion, suggesting growth of 6.3% year over year.

Zacks’ consensus estimate for Cigna’s first fiscal 2022 earnings is pegged at $5.13 per share, suggesting growth of 8.5% from the prior year quarter. CI has a four-quarter earnings surprise of 6%, on average.

Performance Food Group PFGC currently has an Earnings ESP of +10.17% and a Zacks Rank of 2. The Zacks consensus estimate for PFGC’s quarterly revenue is set at $13.11 billion, indicating an increase of 9 .6% compared to the quarter of the previous year.

Zacks’ consensus estimate for Performance Food Group’s first quarter 2022 earnings was flat for the past 30 days at 5 cents per share. The estimate calls for an annual growth of 168%. PFGC has a four-quarter earnings surprise of 1.51%, on average.

Stay on top of upcoming earnings announcements with Zacks Earnings Calendar.

Just Released: Zacks’ 7 Best Stocks For Today

Experts have pulled 7 stocks from the Zacks #1 220 Strong Buys list that have beaten the market more than 2 times with an astonishing average gain of +25.4% per year.

These 7s were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Click to get this free report

Alpha Metallurgical Resources, Inc. (AMR): Free Stock Analysis Report

Cigna Corporation (CI): Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS): Free Stock Analysis Report

Performance Food Group Company (PFGC): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.